IFRS 16 has also had an impact on debt, as additional liabilities are recognized for leases that were previously off balance sheet. Since the adoption of IFRS 16, this is no longer necessary as these companies can present net debt from the balance sheet (which includes lease liabilities). Most of the companies surveyed did not restate the comparative information in their financial statements as they applied the “modified retrospective” approach on transition to IFRS 16.

Great! Hit “Submit” and an Advisor Will Send You the Guide Shortly.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. A company should make estimates and reflect their best guess as a part of the balance sheet if they do not know which receivables a company is likely actually to receive.

Investment Decisions:

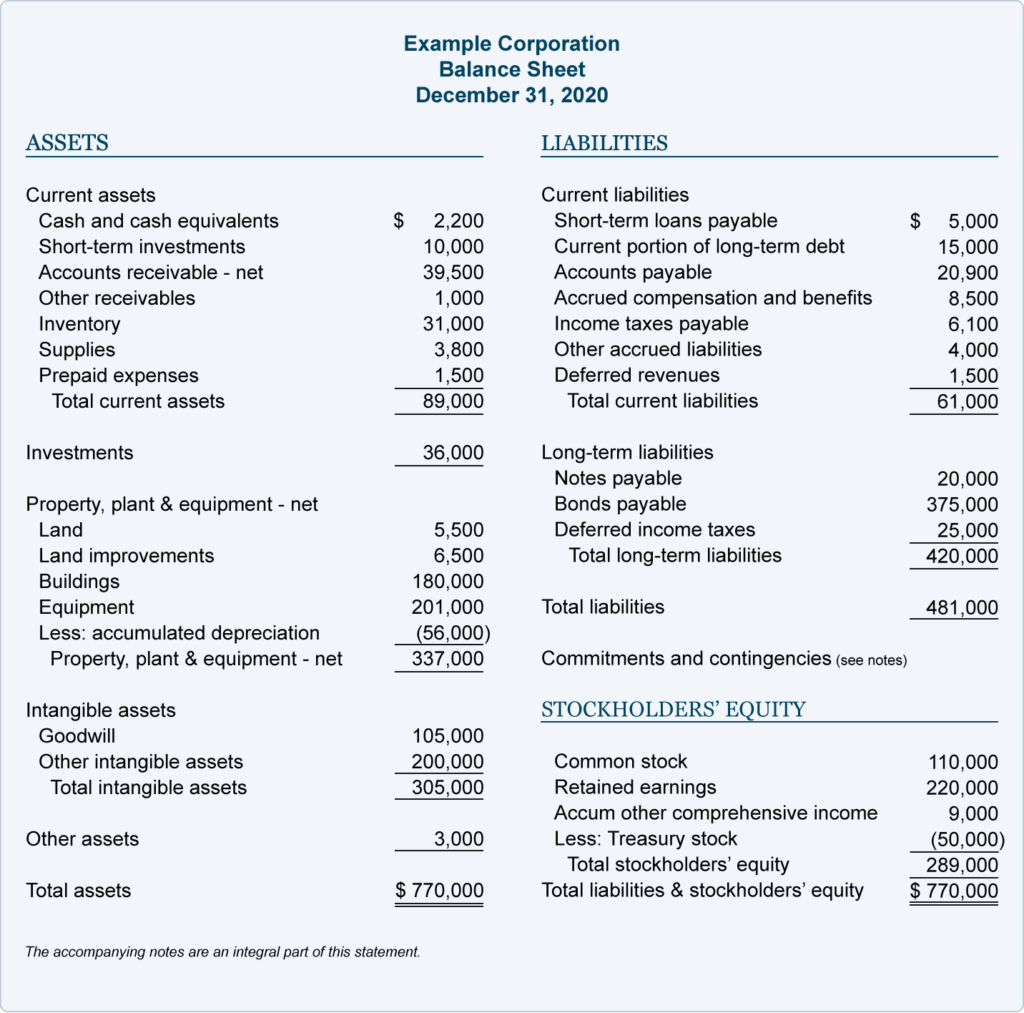

It is helpful for business owners to prepare and review balance sheets in order to assess the financial health of their companies. It may not provide a full snapshot of the financial health of a company without data from other financial statements. It is crucial to remember that some ratios will require information from more than one financial statement, such as from the income statement and the balance sheet. This means that the assets of a company should equal its liabilities plus any shareholders’ equity that has been issued. Accounts within this segment are listed from top to bottom in order of their liquidity.

Shareholders’ Equity

You’ll have to go back through the trial balance and T-accounts to find the error. Balance sheets can tell you a lot of information about your business, and help you plan strategically to make it more liquid, financially stable, and appealing to investors. But unless you use them in tandem with income statements and cash flow statements, you’re only getting part of the picture. Learn how they work together with our complete guide to financial statements. Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard.

Submit to get your question answered.

- For instance, accounts receivable should be continually assessed for impairment and adjusted to reveal potential uncollectible accounts.

- Based on its results, it can also provide you key insights to make important financial decisions.

- External auditors, on the other hand, might use a balance sheet to ensure a company is complying with any reporting laws it’s subject to.

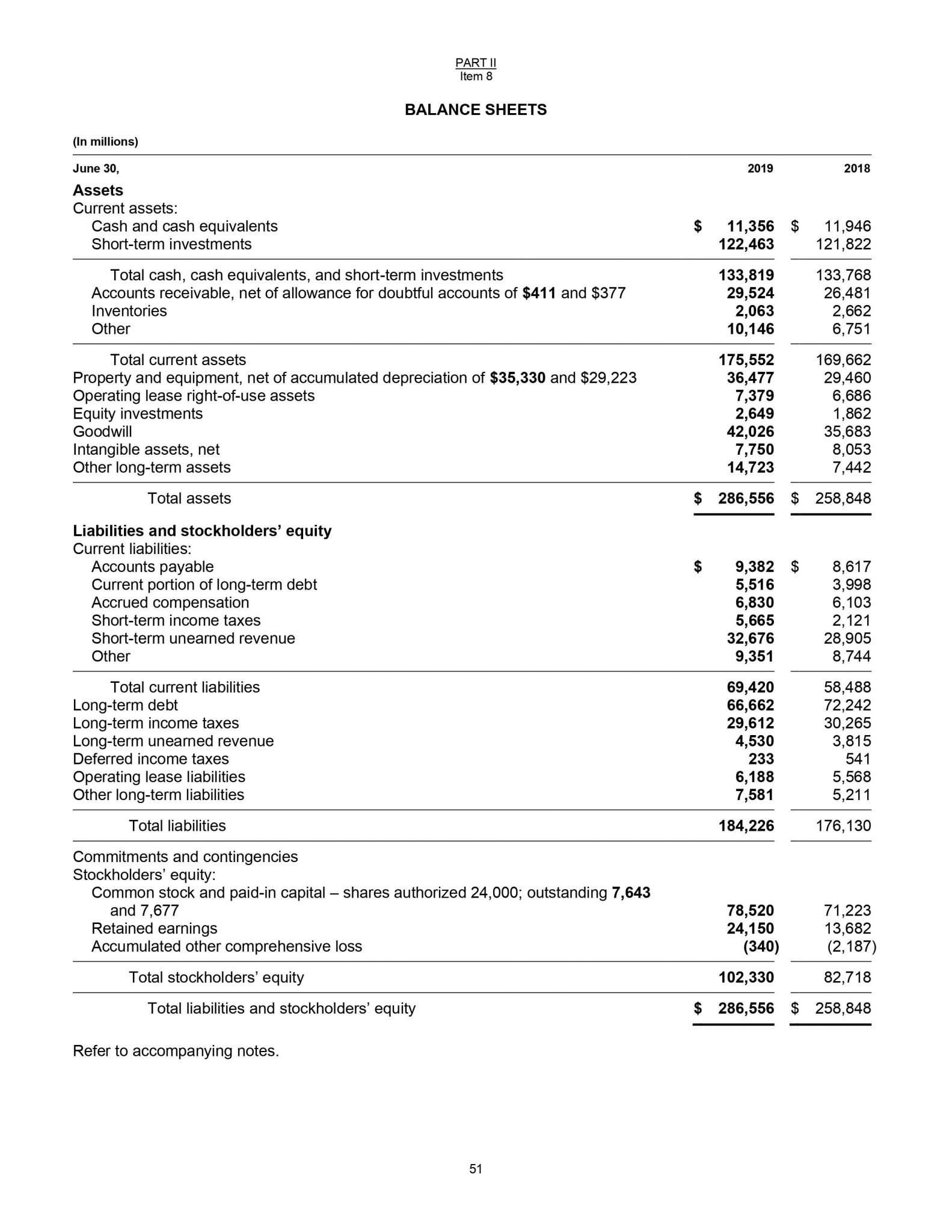

- Subtracting total liabilities from total assets, Walmart had a large positive shareholders’ equity value, over $81.3 billion.

If you were to take a clipboard and record everything you found in a company, you would end up with a list that looks remarkably like the left side of the balance sheet. It’s important to remember that a balance sheet communicates information as of a specific date. While investors and stakeholders may use a balance sheet to predict future performance, past performance is no guarantee of future results.

An accounting method wherein revenues are recognized when cash is received and expenses are recognized when paid. The cash basis of accounting is usually followed by individuals and small companies, but is not in compliance with accounting’s matching principle. A nongovernment group of seven members assisted by a large research staff which is responsible for the setting of accounting standards, rules, and principles for financial reporting by U.S. entities. Current and non-current assets should both be subtotaled, and then totaled together. An asset is anything a company owns which holds some amount of quantifiable value, meaning that it could be liquidated and turned to cash.

Moreover, combining balance sheet reviews with proactive financial planning can help you respond effectively to changing market conditions and make well-informed strategic decisions. When completing your taxes or providing financial information to regulatory authorities. In some cases, businesses are required to submit their balance sheet and other financial statements for tax purposes.

HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. No, all of our programs are 100 percent online, and available to participants regardless of their location. We expect to offer our courses in additional languages in the future but, how do i create a new category or subcategory at this time, HBS Online can only be provided in English. Liabilities may also include an obligation to provide goods or services in the future. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

It shows what belongs to the business owners and the book value of their investments (like common stock, preferred stock, or bonds). Because it summarizes a business’s finances, the balance sheet is also sometimes called the statement of financial position. Companies usually prepare one at the end of a reporting period, such as a month, quarter, or year. A balance sheet explains the financial position of a company at a specific point in time. As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day.

This is why the balance sheet is sometimes considered less reliable or less telling of a company’s current financial performance than a profit and loss statement. Annual income statements look at performance over the course of 12 months, where as, the statement of financial position only focuses on the financial position of one day. A company’s balance sheet provides important information on a company’s worth, broken down into assets, liabilities, and equity. Investors can gain valuable insight from this financial statement since it shows a company’s resources and how it is funded to evaluate its financial health.